CITY OF CEDAR HILL, TX ECONOMIC DEVELOPMENT

Where Opportunities Grow Naturally

The City of Cedar Hill was founded in 1846 by a group of settlers and remained a quiet, small community until the early 1990s. As the population of Cedar Hill increased rapidly, local residents began to be concerned about the need for orderly economic development.

Over the last three decades, this robust growth has made Cedar Hill a prime location for retail, commercial, technology, industrial, healthcare, residential and recreational opportunities. Located in the beautiful natural environment of Joe Pool Lake and Cedar Hill State Park, Cedar Hill is the perfect choice for those who want big-city amenities with a small-town ambiance.

Planners, economists and site selectors have identified Cedar Hill as one of the brightest spots for economic development in Texas. The mission of the Cedar Hill Economic Development Corporation (EDC) is to retain and expand business through a proactive retention and expansion program, attract desirable business and industry by fostering a strong business climate, and aggressively market Cedar Hill, TX utilizing a multi-faceted approach.

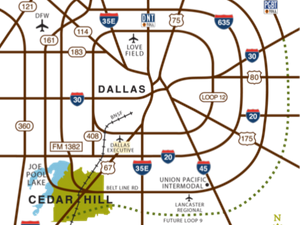

Cedar Hill, TX offers numerous advantages for businesses relocating to the Dallas-Fort Worth region.

-

20 minutes from downtown Dallas

-

30 minutes from DFW Airport

-

40 minutes from downtown Fort Worth

-

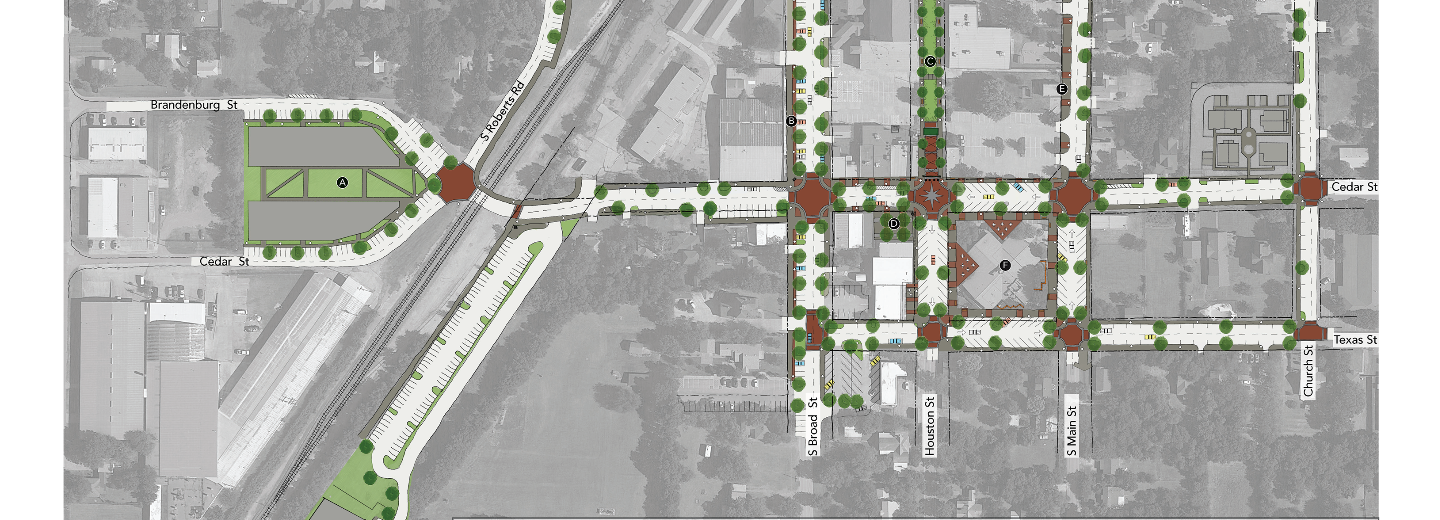

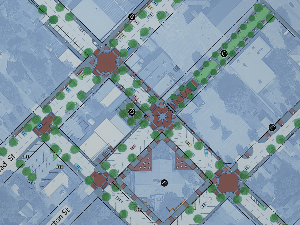

Business Park located near US Hwy 67 with rail access from BNSF

-

A business-friendly environment with a workforce of more than 1 million within a 30 minute commute

-

Low taxes, low cost of living, quality education, more than 3 million square feet of retail and Class A office space

-

Aggressive economic development incentives to facilitate and energize relocation and expansion