Tax Rates

Sales Tax Rates

| Juris Name | Tax Rate | ||

| Cedar Hill | 0.0187500 | ||

| Cedar Hill CC | 0.0012500 | ||

| State Sales Tax | 0.0625000 | ||

| Total Sales Tax Rate | 0.0825000 |

Ad Valorem Tax Rates (Per $100 Valuation)

| City of Cedar Hill | 0.0697028 |

| Cedar Hill ISD | 1.3760000 |

| Dallas County | 0.243100 |

| Dallas School Equalization | 0.010000 |

| Parkland Hospital (County) | 0.279400 |

| Dallas County Colleges | 0.124000 |

| Ellis County | 0.338984 |

| Midlothian ISD | 1.352000 |

Ad Valorem Tax (Property, Personal Property, and Inventory Tax) is based on 100% of market value as appraised by the Dallas Central Appraisal District. City tax exemptions are given to persons 65 years and older for $30,000, and disabled persons based on the severity of the disability. In addition, non-business vehicles are not taxed by the City.

Texas does NOT have income taxes: click here for a list of state taxes.

QUICK LINKS

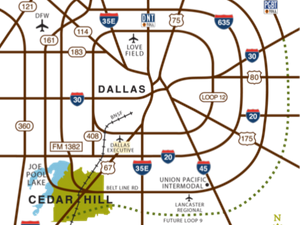

Dallas Central Appraisal District

2949 North Stemmons Freeway, Dallas, TX 75247

214-653-7811 www.dallascad.org

Dallas County Tax Office

500 Elm Street, Records Building, Dallas, TX 75202

214-653-7811 www.dallascounty.org

Ellis County Appraisal District*

400 Ferris Avenue, Suite 200, Waxahachie, TX 75165

972-937-3552 www.elliscad.org

Ellis County Courthouse*

101 West Main Street, Waxahachie, TX 75165

972-825-5000 www.co.ellis.tx.us